Get Matched With Accounting Programs

What Does a CPA or Accountant Do?

While the specific job responsibilities of a CPA vary drastically from industry to industry, the majority of these professionals are tasked with assessing a company or organization’s financial operations. They play an essential role in ensuring the future fiscal success and efficiency of their clients. To better accommodate the unique needs of their employer, many CPAs choose to specialize in a particular kind of accounting work. The three most common types of accountants are public accountants, management accountants, and government accountants.

Are you interested in pursuing a career as a Certified Public Accountant (CPA)? If you enjoy and are good at working with financial information and records, becoming a CPA may be a good fit for you. Whether you are an accounting student or current accounting professional, it is important to realize that becoming a CPA will require significant time and dedication. The undertaking is, however, well worth the effort. Because every industry requires some level of financial oversight, CPAs rarely have trouble finding employment and are often very well compensated.

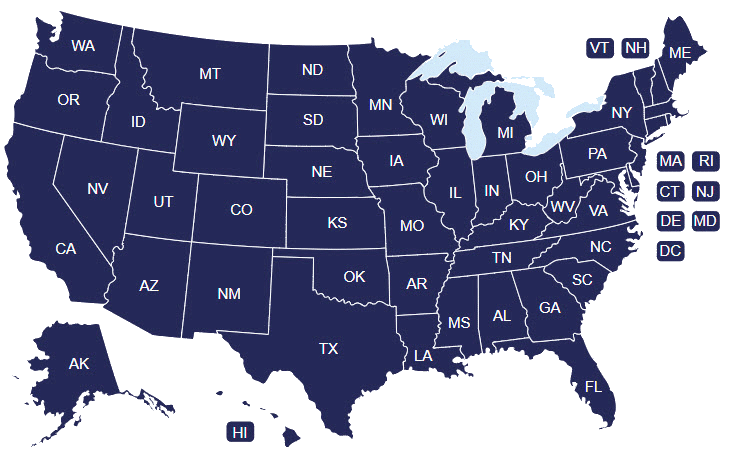

State-By-State College Guides

Select a State to Search Colleges & Universities

- Select a State

-

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Compare Popular Online Accounting Programs

Steps to Becoming an Accountant or CPA

-

Step 1: Research Your State’s Specific Certification Requirements

-

Step 2: Complete the Necessary Online Accounting Degree Requirements

-

Step 3: Apply for, Take, and Pass the Uniform CPA Examination

-

Step 4: Apply for, Take, and Pass an Ethics Examination

-

Step 5: Find Employment with a Licensed CPA

-

Step 6: Complete and Submit Your State’s CPA Licensure Application

-

Step 7: Enroll in Continuing Professional Education (CPE) Courses

Step 1: Research Your State’s Specific Certification Requirements

Every state has its own CPA licensing regulations. While many requirements are similar, it is important to research exactly what is expected in your state before moving forward. Typical requirements include:

- Earn an accounting bachelor’s degree or higher

- Complete a minimum of 150 credit hours in accounting and business

- Pass all four sections of the Uniform CPA Examination

- Pass an ethics examination

- Obtain the necessary professional work experience

- Enroll in continuing education courses

You can usually find the specific CPA licensure requirements detailed on the website managed by your state’s Board of Accountancy.

Step 2: Complete the Necessary Education Requirements

Every state requires CPA candidates to have, at minimum, an undergraduate degree in accounting or a similar field. The typical bachelor’s degree consists of 120 credit hours of coursework, but most states require CPAs to complete 150 total credit hours before applying for licensure. This means additional undergraduate classes will be necessary or that you should plan to enroll in a master’s program after graduating. Alternatively, some colleges and universities offer five-year accounting programs specifically designed to fulfill the 150 credit-hour requirement. While a graduate degree is rarely necessary, having one will qualify you for higher-paying positions and prepare you to deal with advanced auditing, taxation, and finance concepts.

Many states also provide a list of expected coursework. While course expectations vary, most require students to take classes like financial accounting, accounting information systems, cost and managerial accounting, income tax, and auditing. Additionally, most states have an established minimum grade point average that CPA candidates must maintain while enrolled.

Before selecting an accounting program, you must also confirm that it is accredited by an agency accepted by your state’s Board of Accountancy. Most states only recognize an accounting degree provided by colleges and universities that have undergone the accreditation process with a pre-approved association. These include:

- Southern Association of Colleges and Schools

- Middle States Association of Colleges and Secondary Schools

- New England Association of Schools and Colleges

- North Central Association of Colleges and Secondary Schools

- Northwest Association of Schools and Colleges

- Western Association of Schools and Colleges

Step 3: Apply for, Take, and Pass the Uniform CPA Examination

Students can actually apply to sit for the Uniform CPA Examination before completing all of their education requirements. You do, however, need a bachelor’s degree or proof that you will have your accounting degree by the time you take the first examination.

The process for applying to sit for the Uniform CPA examination varies slightly depending on your state’s regulations. In most cases, candidates will need to submit all application and examination fees, as well as provide the requested official school transcripts, reference letters, and supporting legal documents. Once you have been approved, information regarding how to set your examination date will be provided.

The Uniform CPA Examination consists of four sections: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation. Each test is only four hours long, but applicants are discouraged from applying for multiple sections simultaneously. CPA candidates must pass all four sections within an 18-month period in order to qualify for licensure. While passing scores are determined by each state, most require a minimum score of 75 for each section.

Find Your Online Accounting Program

Step 4: Apply for, Take, and Pass an Ethics Examination

After passing the Uniform CPA Examination, most states require CPA candidates take and pass an ethics exam. There is not a single, standard examination accepted by every state, but many use the test provided by the American Institute of Certified Public Accountants (AICPA). This exam is not nearly as difficult as the Uniform CPA examination and can be taken independently online. Most states require a minimum passing score of 90.

Step 5: Find Employment with a Licensed CPA

CPA candidates are also expected to work professionally as an accountant prior to applying for licensure. Every state is a little different, but most require significant work experience be obtained in an industry, government, academic, or public practice. You will usually need, at minimum, 2,000 hours (one year) of experience providing services or advice in accounting, assets, management advisory, auditing, insurance reporting, and financial consulting. All work must be completed under the direct supervision of a CPA licensed by the state you plan to practice in. Most state CPA licensure applications require that all professional experiences be verified by the supervising CPA.

Step 6: Complete and Submit Your State’s CPA Licensure Application

Once you have completed all of the necessary education, testing, and work experience requirements, you will need to complete and submit your state’s CPA licensure application. Be advised that there is usually an initial application fee due at this time. The amount due varies by state.

In most cases, there is no need to send your Uniform CPA Examination test scores, as the AICPA will notify the state’s Board of Accountancy after you have passed all four sections. You may, however, need to provide proof that you passed the ethics examination. While your supervising CPA is responsible for submitting documentation verifying your work experience, you will need to provide him or her with the appropriate paperwork beforehand.

After all documentation has been received, your state’s Board of Accountancy will notify you when your status as a licensed CPA has been established.

Step 7: Enroll in Continuing Professional Education (CPE) Courses

After being designated a CPA in your state, you will need to renew your license regularly. Some states require this be done yearly, while others have longer renewal timeframes. As part of maintaining your CPA licensure, you must successfully complete a certain number of Continuing Professional Education (CPE) each year. The number of classes you need is different in every state, but most require a minimum of 80 CPE credits. Courses must be board-approved, and topics generally include accounting, auditing, business law, economics, finance, statistics, taxes, human resources, communications, and marketing.

It will be your responsibility to track and maintain documentation for your CPE credits each year. Some states require this information be submitted, while others perform periodic audits.

What Does a CPA Do vs. an Accountant?

Most accountants are responsible for preparing and examining financial records. They also ensure that a company or organization’s financial records are accurate and that all taxes are paid in a timely manner. Additionally, these professionals often provide suggestions to reduce costs and spending, improve profitability, and boost financial returns. Other common duties include:

- Maintaining financial records

- Reviewing financial reports

- Verifying company and legal compliance

- Overseeing tax responsibilities

- Examining account books

- Establishing efficient accounting systems

- Evaluating financial operations

- Recommending better financial management procedures

- Generating written and verbal financial reports

- Communicating financial findings

CPAs are accountants who are licensed to practice in their given state. While they often perform many of the same tasks as uncertified accountants, they are also qualified to write audited financial statements for companies that sell shares on the stock market. Additionally, CPAs can legally represent individuals or organizations during an IRS audit. They are generally better regarded and earn a higher income than basic accountants.

Both accountants and CPAs tend to work in offices, although some may work at home or travel to meet with clients. All accounting professionals are required to have, at minimum, a bachelor’s degree. CPAs, however, must complete 30 additional hours of coursework before becoming licensed. They must also pass all four sections of the Uniform CPA Examination administered by the American Institute of Certified Public Accountants (AICPA).

CPA Skills to Acquire

Not everyone is capable of becoming a CPA. The accounting field is extremely demanding and requires substantial education, training, and experience. Because the work performed by CPAs is multifaceted, these professionals must develop and hone several important skills.

The most successful CPAs in the field possess the following traits:

- Commitment to and passion for the financial industry

- Firm understanding of mathematical concepts and an ability to analyze, compare, and interpret figures quickly

- Excellent organization of financial data, including figures and financial paperwork for a variety of clients

- Time management skills that allow for multi-tasking and the effective use of office hours

- Detail-oriented nature and an eye for accuracy, especially when compiling and examining financial documentation

- Exceptional customer service when working directly with clients

- Creativity and an ability to think outside of the box to develop quick, fresh solutions to financial problems

- Unwavering trustworthiness regarding private and confidential company and client information

- Outstanding communication with clients and company management

- Collaboration with team members, department managers, and decision-makers

- Flexibility to work effectively in constantly changing environments and address last-minute challenges

Find Online Accounting Schools

Certification and Licensure Requirements

While the only way to become a CPA is to apply for licensure in your state, there are alternative means of meeting some of the application requirements. If, for example, you are eager to begin your career in accounting as soon as possible, you may want to enroll in an online accounting BS program. This level of accounting degree can be attained in one to two years, depending on the institution, and will qualify you for entry-level positions in the field.

From there, you can enroll in an undergraduate degree program. Some colleges and universities will waive course requirements if you have already completed comparable classwork, which can shorten the amount of time spent pursuing your bachelor’s degree. Alternatively, you can begin working professionally right away. While you will still need an undergraduate degree to apply for CPA licensure, some states do waive the additional 30 credit hours of coursework if candidates have some professional experience.

The required qualifications often vary in detail from state to state. Every state (and an additional five districts) has their own Board of Accountancy. Each Board is responsible for creating and enforcing the guidelines needed to secure your CPA license and practice legally within your state, which you can view on your state's site.

Though each state has their own rules, the Uniform Accountancy Act streamlines the process so that it doesn’t vary too greatly depending on where you live. This bill was jointly created in 1984 by NASBA and the American Institution of Certified Public Accountants (AICPA) to reduce discrepancies in what states need.

In every state, CPA candidates must first complete the three E’s to qualify for licensure: education, examination, and experience. Each prospective CPA must complete at least 150 semester hours of college or university credits as students, pass the Uniform CPA test, and gain at least one year of verifiable accounting work experience prior to licensure to build their skills.

However, the policy varies from state to state when it comes to the individual specifications that must be met in each stage of eligibility. Credit distribution, required courses, years of higher education necessary, and pre-exam study requirements may change depending on which state you’re seeking licensure in, as can the necessary experience hours and nature of work. Many states also require completion of an approved ethics class prior to licensure.

Before you can apply for your CPA license, you’ll also need to meet a predetermined number of verifiable supervised hours performing specific accounting tasks. This generally needs to take place over at least one year, accumulating a number of hours that vary based on your state (often somewhere between 1200 and 1800).

Relevant experience must take place in a public or private practice, or a government, academic, or industry setting. You’ll need to be supervised, likely by a licensed CPA. Check with your state’s Accountancy Board for help finding information on experience needed if you want to receive your license.

Your experience must cover a variety of the tasks you’ll be expected to handle upon licensure to ensure you learn and review these tasks. These fields may include taxation, auditing, attestation, business accounting, and/or finance.

No matter what state you’re in, you’ll be required to complete a number of Continuing Professional Education (CPE) hours each year after licensure. Exactly what you'll need varies on a state-by-state basis, but you can expect to attend classes, seminars, and the occasional meeting to make sure you’re up to date on constantly changing rules and regulations. Because each state sets its own CPA licensure standards, it is important to research the specifics of the process in your area before committing to an alternative course of action.

Accountant Career Path and Salary

According to the Bureau of Labor and Statistics, the median annual wage for most accountant and auditor positions in 2017 was $69,350. PayScale, on the other hand, reports an average salary of $64,377 for CPAs. Both of these figures are well above the median annual wage of $37,690 reported for all occupations. Entry-level CPAs can expect to make around $56,000 annually, while those with 20 or more years of experience can earn as much as $93,000 a year. Salary is also impacted by location; the top paying states for this occupation include the District of Columbia, New York, New Jersey, Virginia, and California.

Search Programs Offering Accounting Majors

Potential Employment

Because nearly every company and organization requires some level of financial management, CPAs can find employment in a wide variety of industries. From small businesses to multi-million dollar corporations, all companies benefit from working with an accounting professional. That said, the industries that hire CPAs most often are:

- Accounting, Tax Preparation, Bookkeeping, and Payroll Services

- Management of Companies and Enterprises

- Local Government Organizations

- State Government Organizations

- Management, Scientific, and Technical Consulting Services

- Oil and Gas Extraction Companies

- Insurance and Employee Benefits Companies

- Securities, Commodity Contracts, and Other Financial Investments Services

Many CPAs work for companies that specialize in assurance or risk management. They may also work for organizations that provide services to specific trades, such as healthcare, law enforcement, or education. Additionally, some CPAs decide to establish their own financial practice.

Potential Career Paths

There are many employment opportunities available to individuals with a background in accounting. Becoming a CPA is not the only career option. In fact, there are numerous jobs both above and below that of a CPA. The constant need for financial management assistance also increases the number of jobs available. While accounting professionals can find work in nearly any industry, some of the most common professions include:

- Accountant

- Accounting Manager

- Administrative Assistant

- Chief Financial Officer (CFO)

- Finance Director

- Financial Controller

- Senior Accountant

Administrative Assistant

Administrative assistants employed in the accounting field are responsible for providing support to other financial management staff members. They frequently greet clients, type correspondence, compile data, schedule travel, and coordinate office organization.

Accounting Manager

Accounting managers are responsible for developing and implementing systems for gathering, analyzing, verifying, and reporting financial information. They usually maintain general ledger accounts, payroll transactions, and accounts payable.

Chief Financial Officer (CFO)

Chief financial officers (CFOs) usually oversee the development of internal control policies, guidelines, and procedures for budget administration, credit management, and accounting. They often prepare financial statements, business activity reports, and financial position forecasts.

Finance Director

Financial directors generally lead a finance team responsible for establishing accounting and financial analyses plans for a company or organization. They often oversee the preparation of regulatory and financial reporting, as well as develop policies and procedures to control and report financial data.

Financial Controller

Financial controllers manage the various financial departments of a company or organization. This usually includes the budget department, audit department, and accounting department. Their primary role is to ensure policies and procedures are in compliance with established standards.

Senior Accountant

Senior accountants are often responsible for keeping a company or organization’s financials organized. These professionals generally maintain business records of assets, investigate budget variance issues, supervise other financial team members, and analyze financial data for reports and forecasts.

Accountant CPA Careers and Salary

| Occupation | Entry-Level | Mid-Career | Late-Career |

|---|---|---|---|

| Certified Public Accountant | $54,000 | $71,000 | $89,000 |

| Financial Accountant | $48,000 | $60,000 | $59,000 |

| Accounting Manager | $58,000 | $76,000 | $71,000 |

| Senior Accountant | $61,000 | $70,000 | $70,000 |

| Budget Analyst | $51,000 | $66,000 | $78,000 |

| Credit Manager | $51,000 | $66,000 | $73,000 |

| Forensic Accountant | $59,000 | $83,000 | $96,000 |

| Investment Banker | $79,000 | $121,000 | $128,000 |

| Tax Accountant | $53,000 | $64,000 | $70,000 |

**Salary info provided by PayScale

Find Online Colleges Offering Accounting

Career Outlook

Overall, the outlook for accountants and CPAs working in the United States is very promising. In fact, the Bureau of Labor and Statistics projects that there will be a 10% increase in job availability between 2016 and 2026. This is faster growth than the national average for other professions. The major reasons for this growth are likely globalization, an ever-changing economy, and complicated tax regulations. Additionally, as more and more large companies go public, the need for licensed professionals capable of handling this type of financial documentation will increase.

The only major concern regarding career outlook for CPAs is the further development of cloud computing. As this trend becomes more popular, some routine accounting tasks may become automated. While this will likely increase field efficiency, it could also result in a decrease in demand for accountants and CPAs in the future.

It is also worth noting that the level of employment varies per state. The locations with the highest rates of employment for accountants include, but are not limited to, California, Texas, New York, Florida, and Pennsylvania.

Advancing From Here

In addition to becoming licensed as a CPA, there are several other certifications that accountants may consider seeking.

Some of the most popular options include:

- Certified Financial Analyst (CFA)

- Certified Management Accountant (CMA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

- Certified Fraud Examiner (CFE)

- Certified Government Auditing Professional (CGAP)

- Certified Bank Auditor (CBA)

CPAs may also benefit from joining a professional organization or association. These often provide a number of great member benefits, such as access to field resources, CPE courses, and networking. Additionally, they may offer an opportunity to take on additional leadership roles in the field.

- American Accounting Association (AAA)

- National Society of Accountants (NSA)

- American Institute of CPAs (AICPA)

Find Accountant and CPA Jobs Near You

Frequently Asked Questions

What are some other accounting careers with a degree in accounting?

With an accounting degree, some accounting careers you can work as are a financial analyst, financial analyst, financial examiner, finance manager, financial consultant, business consultant, budget analyst, and forensic accounting.

What is the workplace of an accountant like?

The most common places accountants work are large professional corporations or firms within business districts. They may also work in smaller firms, home offices, or clients offices.

What is a forensic accountant?

A forensic accountant is responsible for going through financial records to find where money has gone missing and figure out how to recover it.

What is tax accounting?

Tax accounting is focused on taxable income instead of profit. Tax accounting helps clients to prepare tax forms that follow tax laws.

How long does it take to get an accounting degree?

Every state requires a minimum of an associates degree to work in accounting. These degrees take around two years to complete. Most jobs will want you to have a four year bachelor's degree.